- Good business performance in 2021 in challenging market environment:

- Group sales reach 20.1 billion euros, +7.8 percent organic growth

- Operating profit* increases to 2.7 billion euros, +4.2 percent

- EBIT margin* on prior-year level: 13.4 percent

- Earnings per preferred share (EPS)*: 4.56 euros, +9.2 percent adjusted for currency effects

- Good free cash flow of 1.5 billion euros, net financial position significantly improved

- Proposed dividend on prior-year level: 1.85 euros per preferred share

- Outlook 2022 and mid- to long-term financial ambition unchanged

- Consistent implementation of agenda for Purposeful Growth since 2020

- Key measures to take strategic growth agenda to next level:

- Integration process of Laundry & Home Care and Beauty Care to one multi-category platform with around 10 billion euros sales started

- Further portfolio optimization planned in the consumer goods business

- Share buyback program with a volume of up to 1 billion euros started

- Venture Fund II with a total volume of 150 million euros

- New sustainability strategy and ambitions

“Overall, we delivered a good business performance in 2021 and consistently drove the implementation of our strategic agenda forward – despite a very challenging market environment with unprecedented disruptions in global supply chains, a shortage of key raw materials as well as overall significantly increasing prices,” said Henkel CEO Carsten Knobel.

“We recorded organic growth across all business units, kept our margin stable and achieved a very strong increase in earnings per preferred share. This is the achievement of our global Henkel team. Together, we managed to advance our Purposeful Growth agenda – even in these challenging times. I would like to thank all employees for their extraordinary engagement. Particularly those that kept our production and business-critical processes running on site.”

Henkel achieved organic sales of around 20.1 billion euros in fiscal 2021. This corresponds to an organic sales growth of 7.8 percent versus 2020. A significant recovery in demand in industrial and Hair Salon businesses had a particularly positive effect. In the consumer goods business, demand in many categories returned to more normal patterns compared to the previous year 2020, when demand was particularly strong for hygiene and cleaning products as well as hair colorants while demand for styling products was less strong. At the same time, the impact of significantly increasing raw material and logistics prices as well as currency effects weighed on profitability in fiscal 2021. Thanks to significantly higher sales volumes, successful price increases, active cost management and ongoing structural adjustments, Henkel was able to more than offset the impact on its earnings. Adjusted operating profit increased by 4.2 percent to 2.7 billion euros. The adjusted return on sales was at 13.4 percent on prior-year level and adjusted earnings per preferred share rose to 4.56 euros. This corresponds to a significant improvement of 9.2 percent at constant exchange rates.

Based on these results, Henkel will propose a stable dividend of 1.85 euros per preferred share and 1.83 euros per ordinary share to its shareholders at the upcoming Annual General Meeting. This equals a payout ratio of 40.5 percent, which is slightly above the target range of 30 to 40 percent of adjusted net income after non-controlling interests. The company has paid a stable dividend since the beginning of the COVID-19 pandemic.

In addition, Henkel has announced a share buyback program with a volume of up to 1 billion euros at the end of January 2022 and already started the implementation in February. Henkel plans to buy back preferred shares with a total value of up to 800 million euros and ordinary shares with a total value of up to 200 million euros. The program is expected to be carried out latest until March 31, 2023.

“We are consistently driving the implementation of our strategic agenda and have made very good progress in many key areas. In some areas, however, we see the need for further action. Therefore, we are now taking our agenda for Purposeful Growth to the next level: at the end of January, we announced the merge of our business units Laundry & Home Care and Beauty Care into one new business unit ’Henkel Consumer Brands‘. With that we create a multi-category platform with around 10 billion euros sales. This provides a broader basis to optimize our portfolio even more consistently and bring it to a higher growth and margin profile. That is also reflected in our mid- to long-term financial ambition,” said Carsten Knobel. “In addition, our new Venture Fund II with a volume of 150 million euros and our new 2030+ Sustainability Ambition Framework are providing important impetus in the areas of innovation and sustainability. And the new open and dynamic look of our corporate brand reinforces our purpose.”

Group sales and earnings performance in fiscal 2021

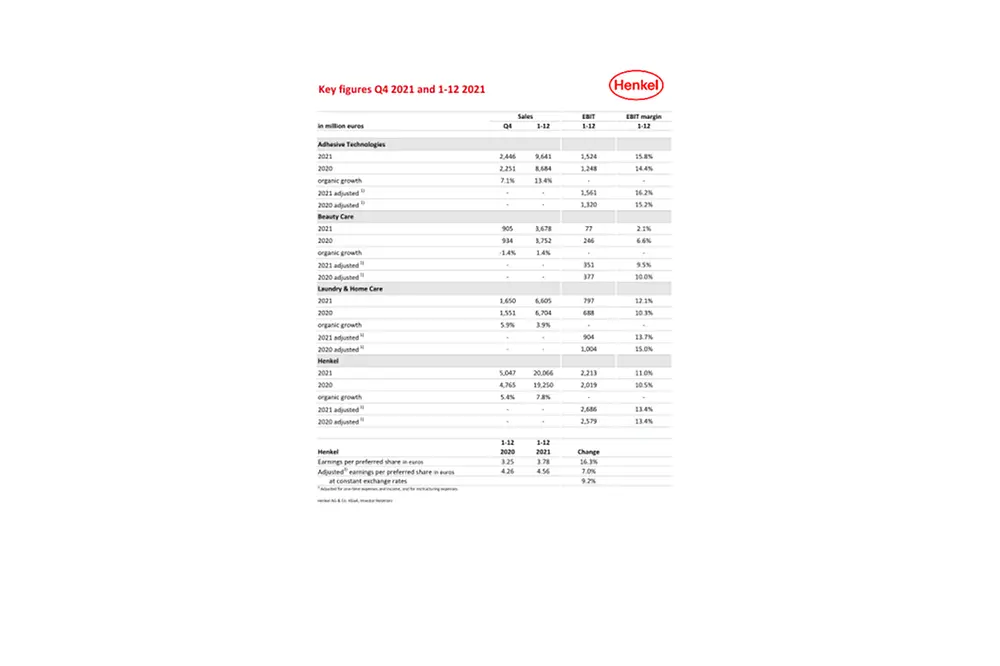

Henkel Group sales reached 20,066 million euros in fiscal 2021. This corresponds to a nominal growth of 4.2 percent and to a significant organic sales growth of 7.8 percent. The impact of acquisitions and divestments on sales was slightly negative at -0.1 percent. Currency effects had a negative impact of -3.5 percent on sales.

The Adhesive Technologies business unit delivered double-digit organic sales growth of 13.4 percent, driven primarily by a significant recovery in industrial demand compared with the prior-year period, which was heavily impacted by the COVID-19 pandemic. Sales in the Beauty Care business unit grew organically by 1.4 percent. While the recovery in the hair salon business had a positive effect, Beauty Care’s consumer business was impacted in particular by a normalization of demand in the body care category and showed a declining development. The Laundry & Home Care business unit achieved strong organic sales growth of 3.9 percent, with both business areas Laundry Care and Home Caredelivering a strong performance.

The emerging markets achieved double-digit organic sales growth of 15.4 percent. The businesses in the mature markets recorded a good organic sales performance of 2.5 percent.

Adjusted operating profit (adjusted EBIT) increased by 4.2 percent to 2,686 million euros in 2021, compared to 2,579 million euros in fiscal 2020. Adjusted return on sales (adjusted EBIT margin) reached the level of the previous year at 13.4 percent.

Adjusted earnings per preferred share rose by 7.0 percent to 4.56 euros (previous year: 4.26 euros). At constant exchange rates, adjusted earnings per preferred share increased by 9.2 percent.

Net working capital increased to 2.2 percent, up 1.5 percentage points compared to the previous year’s exceptionally low figure of 0.7 percent. Thus, net working capital is returning to more normal levels. Compared to the pre-crisis level of 2019, it improved by 1.7 percent.

Free cash flow totaled to 1,478 million euros, down from the figure for the previous year

(2020: 2,340 million euros), which had been boosted by an unusually sharp decline in net working capital within cash flow from operating activities.

The net financial position improved significantly, mainly due to the good free cash flow. Effective December 31, 2021, the net financial position amounted to -292 million euros (December 31, 2020: -888 million euros).

Business unit performance in fiscal 2021

Sales of the Adhesive Technologies business sector increased by 11.0 percent in nominal terms in fiscal 2021, reaching 9,641 million euros. Organically, sales increased by 13.4 percent. This growth was driven by both significantly higher volumes and a steady increase in pricing as the year progressed. Growth in the first six months of the year was characterized by a broad-based volume-driven recovery in industrial demand compared to the prior-year period, which had been strongly impacted by the COVID-19 pandemic. The organic sales growth in the second half of the year was driven both by further strong volume development and, increasingly, by price increases. At 1,561 million euros, adjusted operating profit was significantly above the level of the previous year (1,320 million euros). Adjusted return on sales increased by 100 basis points and reached 16.2 percent, positively impacted, particularly, by the double-digit percentage sales growth.

In the Beauty Care business unit, sales declined nominally by -2.0 percent in fiscal 2021 to 3,678 million euros. Organically, sales increased by 1.4 percent. This was due to different developments. While the significant recovery in the hair salon business had a positive effect, the consumer business was impacted by a normalization of demand in the body care category and recorded a declining development. Adjusted operating profit reached 351 million euros (previous year: 377 million euros). Adjusted return on sales declined to 9.5 percent (previous year: 10.0 percent). This was due, among others, to higher investments in marketing and advertising, and significantly higher raw material prices.

Sales of the Laundry & Home Care business unit declined by -1.5 percent in nominal terms to 6,605 million euros in fiscal 2021. Organically, sales increased by 3.9 percent. At 904 million euros, adjusted operating profit was below the prior-year level (1,004 million euros). Adjusted return on sales decreased by 130 basis points to 13.7 percent, mainly driven by the impact of significantly higher raw material and logistics prices.

Outlook 2022

The outlook for fiscal 2022, which was already published at the end of January, remains unchanged. Considering high market uncertainty and volatility and the impact of further substantial increases in raw material and logistics costs, the company expects organic sales growth in the range of 2 to 4 percent, and an adjusted return on sales (EBIT margin) between 11.5 and 13.5 percent. At Group level, Henkel expects for adjusted earnings per preferred share (EPS) a development in the range between -15 to +5 percent (at constant exchange rates) in fiscal 2022.

Agenda for Purposeful Growth: good progress in implementation

Two years ago, beginning of March 2020, Henkel presented its growth agenda for the coming years and developed a clear strategic framework to achieve it. Key elements of the strategic framework are a successful portfolio, clear competitive edge in the areas of innovation, sustainability, and digitalization as well as future-ready operating models – based on a strong company culture.

Portfolio management executed as planned

As part of the active portfolio management, Henkel had set the target at the beginning of 2020 to divest or discontinue brands and businesses with a sales volume of around 0.5 billion euros by the end of 2021. As planned, Henkel has signed divestment agreements, completed divestments or discontinued activities by the end of 2021 with a total annual sales volume of around 0.5 billion euros. The majority of these portfolio measures are in the areas of Beauty Care and Laundry & Home Care, for example the divestment of the brands Right Guard and Dry Idea.

In addition, Henkel has also strategically strengthened its portfolio in 2021 with a promising, high-growth acquisition. In the business unit Laundry & Home Care, Henkel has further expanded its position in the French market with the acquisition of Swania. The portfolio is represented in very attractive and profitable market segments and complements Henkel’s portfolio with established, innovative brands such as Maison Verte and YOU.

At the beginning of February 2022, Henkel further strengthened its Professional portfolio with the acquisition of Shiseido’s Hair Professional business in Asia-Pacific. The transaction comprises premium Professional products with sales of more than 100 million euros in fiscal 2021. By expanding its Professional business in Asia-Pacific, Henkel will become one of the leading players in this highly dynamic region with attractive future growth potential.

To strengthen its competitive edge, Henkel focused on further accelerating innovations, boosting sustainability as a differentiating factor, and on increasing value creation for customer and consumers through digitalization.

Innovations successfully launched

In the area of successful innovations, Henkel has made further progress in fiscal 2021. Here, the internal idea factories and incubator teams also contributed that have been established in the past year in the business units Beauty Care and Laundry and Home Care. In Adhesive Technologies, the new global innovation center in Düsseldorf with a total investment of around 130 million euros was opened. Work has already begun in the construction of another state-of-the-art innovation center of Adhesive Technologies in Shanghai.

In fiscal 2021, Henkel again successfully introduced many innovations to the market and adequately supported them with investments. In Adhesive Technologies, Henkel for example developed and launched solutions for the automotive industry where sustainable adhesive technologies support thermal dissipation. In addition, innovative adhesives enable the development of sustainable packaging solutions.

In Beauty Care, Henkel has extensively relaunched the hair styling brand Taft as well as the hair colorant brand Igora Royal and successful innovations were launched in the Hair Care segment. Furthermore, the range of the sustainable brand Nature Box has been expanded through further products in solid form and refill packs.

In Laundry & Home Care, detergent caps were strengthened by innovations covering all price segments and are available under various brands, including Perwoll. Henkel has also launched the sustainable Persil Eco Power Bars in some European countries in retail stores. Innovations in the area of cleaning agents include the dishwasher caps “Somat Excellence”.

Henkel has also launched a new Venture Fund II with a volume of 150 million euros to invest in innovative and new business models through participation in start-ups or venture capital funds.

Significant progress in the area of sustainability

As part of its strategic agenda, Henkel is focusing on sustainability to clearly differentiate itself from competition, to generate purposeful growth and create value for its stakeholders. Henkel made significant progress in this area in 2021. This includes, for example:

- Compared to the base year 2010, Henkel has reduced CO2 emissions in its production by 50 percent in fiscal 2021 and increased the share of green electricity to more than one-third.

- By the end of 2021, Henkel fully converted production in 21 countries to electricity that is 100 percent renewable.

- The proportion of recyclable or reusable packaging has been increased to 86 percent. The aim is to achieve 100 percent by 2025.

In the area of sustainable finance, Henkel was able to once again provide important impulses, for example by presenting a “sustainable finance framework” in which sustainable bonds can be placed in the future. In 2021, Henkel was the first company in its industry to issue a euro bond with interest rates linked to the achievement of specific sustainability targets. In total, Henkel issued sustainability bonds with a volume of more than 700 million euros last year.

New sustainability strategy and ambitions published

To reflect the growing importance of sustainable management and the rising expectations of customers and society, Henkel has enhanced its long-term sustainability strategy with the introduction of a new “2030+ Sustainability Ambition Framework”. In addition to existing goals, new long-term ambitions have been set in the three dimensions of “Regenerative Planet”, “Thriving Communities” and “Trusted Partner” to drive further progress.

The “Regenerative Planet” dimension deals with important topics such as climate, circular economy and natural resources. Henkel now aims for climate-positive operations by 2030 – ten years earlier than previously planned – and aims to set a net-zero pathway for Scope 3 emissions (from source to shelf) in line with the Science Based Targets initiative. To help achieve this, 100 per cent of the procured electricity will come from renewable energy sources by 2030.

To promote a circular economy, Henkel is pursuing the goal that 100 percent of its packaging will be recyclable or reusable by 2025. This includes increasing the share of recycled plastic for all packaging of consumer goods products to more than 30 percent. In addition, Henkel aims to achieve a circular use of water and production waste material at its production sites by 2030. The company is also well on track to achieve its 2025 target of reducing water consumption per tonne of product by 35 percent (compared to base year 2010).

In the future, Henkel will consolidate topics such as equal opportunity, education, and well-being under the “Thriving Communities” dimension. Henkel has set itself the ambition of achieving gender parity across all management levels in the company by 2025. A key contribution of the third dimension, “Trusted Partner”, is the goal of achieving 100 percent transparency in the procurement of palm (kernel) oil by 2025 and the commitment to 100 per cent responsible sourcing together with all business partners.

Digitalization further advanced

Next to innovation and sustainability, Henkel has defined digitalization as a strategic priority to strengthen its competitive edge and made important progress in 2021. Digital sales again increased by a double-digit percentage across all three business units. The share of digital sales at Group level thus increased to more than 18 percent. The digital unit Henkel dx together with the three business units continued to drive the digital transformation in the company and opened the first “Innovation Hubs” in Berlin and Shanghai. An integrated platform for digital business and e-commerce, developed together with Adobe, is intended to accelerate innovations, and create new growth opportunities for Henkel.

Future-ready operating models expanded

Lean, fast, and future-ready operating models are important elements of Henkel’s strategic framework. Henkel has further expanded the changes launched in 2020: in Adhesive Technologies, the new structure with four business divisions made up of 11 strategic business units is firmly anchored. In the units Laundry & Home Care and Beauty Care, the organizational changes for a stronger regional focus and greater proximity to customers and consumers were further implemented. In addition, the purchasing organization was aligned even more closely to the business units and markets. The planned merger of the Laundry & Home Care and Beauty Care business units into ‘Henkel Consumer Brands’ business unit will also lead to further optimization of structures.

Strengthening of the corporate culture

Henkel has further strengthened its corporate culture as part of its strategic agenda. In 2020, Henkel created a new company purpose and launched it internally and externally: “Pioneers at heart for the good of generations”. The new purpose is a central guiding principle that unites all employees at Henkel. With a new, dynamic visual appearance of the corporate brand, Henkel underlines the aspiration to be a pioneer in driving positive developments in its markets and social environment.

To promote the corporate culture, numerous trainings and advanced training offers were implemented in 2021. Among other things, a comprehensive 360-degree feedback program was introduced for senior managers. Henkel has also developed a holistic concept called “Smart Work” which in the future will provide a global framework for topics such as mobile work, digital workplace or employee health.

Integration process for new Consumer Brands unit started

End of January 2022, Henkel announced comprehensive measures to take the implementation of the Purposeful Growth agenda to the next level. Henkel plans to merge the units Laundry & Home Care and Beauty Care into one new business unit: Henkel Consumer Brands. With the new business unit, Henkel will build one multi-category platform for the complete consumer business under one roof, including many iconic brands such as Persil and Schwarzkopf as well as the Hair Professional business. The new business unit will have around 10 billion euros in sales. The merger is designed to drive growth and profitability for the consumer business and the company.

The preparations for the integration process of the new business unit have already started. This includes initial, constructive talks with employee representatives. The organizational structure of the future business unit has also been defined and internally communicated – with four regions and two global business segments supported by central functions. In addition, the first management level under the responsible member of the Management Board has been determined and a project organization has been established for the upcoming merger of the two business units.

Summing up, Carsten Knobel said: “We have made further progress 2021 in the implementation of our strategic agenda and achieved an overall good business performance. Although we continued to face a global pandemic as well as significantly tight supply chains and exceptionally sharp increases in raw material and logistics prices. We are now looking ahead – to the tasks that lie ahead of us in 2022 and the years beyond. We build on a clear strategy to generate purposeful growth and a strong team with highly motivated employees worldwide. We trust in our shared values, our culture, and our purpose to guide us. I am fully convinced that we will achieve our ambitious goals and successfully implement our Purposeful Growth agenda.”

* Adjusted for one-time expenses and income, and for restructuring

This information contains forward-looking statements which are based on current estimates and assumptions made by the corporate management of Henkel AG & Co. KGaA. Statements with respect to the future are characterized by the use of words such as “expect”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, and similar terms. Such statements are not to be understood as in any way guaranteeing that those expectations will turn out to be accurate. Future performance and results actually achieved by Henkel AG & Co. KGaA and its affiliated companies depend on a number of risks and uncertainties and may therefore differ materially from the forward-looking statements. Many of these factors are outside Henkel’s control and cannot be accurately estimated in advance, such as the future economic environment and the actions of competitors and others involved in the marketplace. Henkel neither plans nor undertakes to update any forward-looking statements.

This document includes – in the applicable financial reporting framework not clearly defined – supplemental financial measures that are or may be alternative performance measures (non-GAAP-measures). These supplemental financial measures should not be viewed in isolation or as alternatives to measures of Henkel’s net assets and financial positions or results of operations as presented in accordance with the applicable financial reporting framework in its Consolidated Financial Statements. Other companies that report or describe similarly titled alternative performance measures may calculate them differently.

This document has been issued for information purposes only and is not intended to constitute an investment advice or an offer to sell, or a solicitation of an offer to buy, any securities.